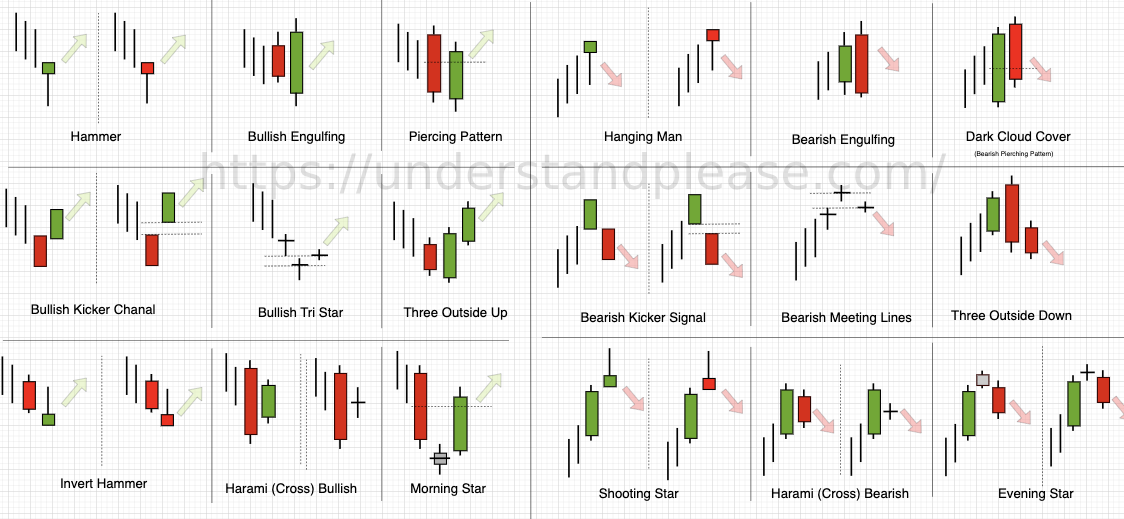

Candlestick patterns are one of the tools used by Forex traders to analyze charts and predict future price directions. This relies on observing past price movements that recur and form specific patterns.

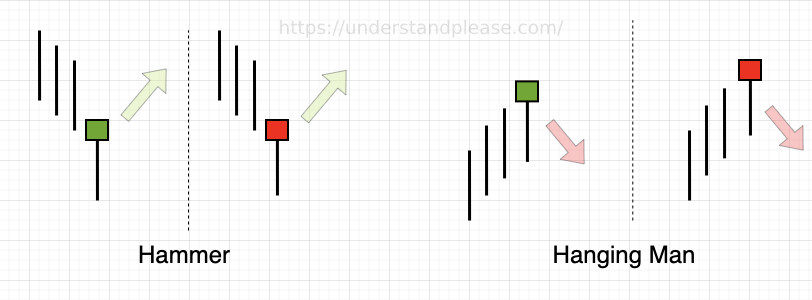

Candlesticks with a small body and a long shadow pointing down (Hammer) or up (Hanging Man) indicate an attempt by buyers or sellers to reverse the trend.

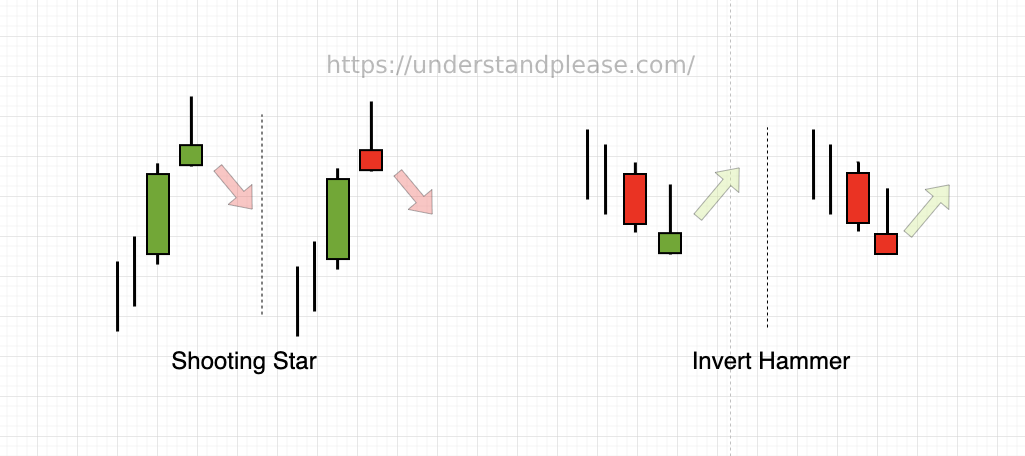

Contrary to the Hammer and Hanging Man, these candlesticks indicate an attempt to reverse the trend in the opposite direction.

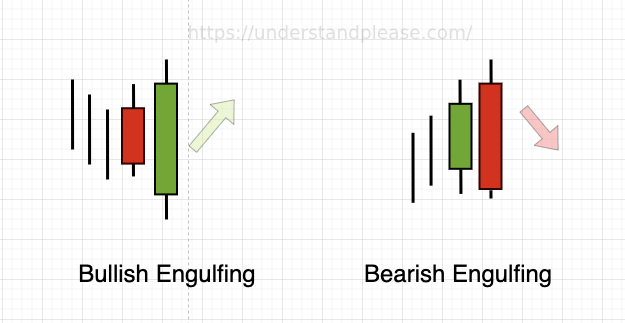

The second candlestick "engulfs" the entire first candlestick with a contrasting color, indicating a change in market momentum.

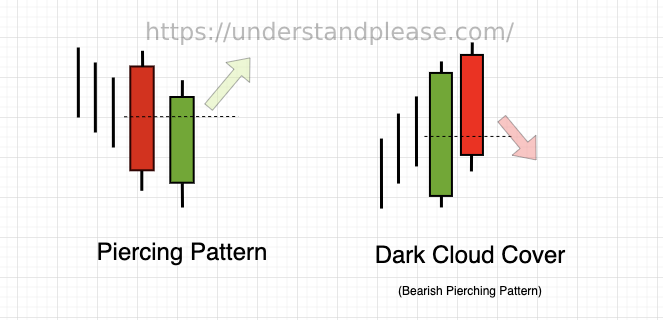

Patterns formed by two candlesticks, indicating a trend reversal.

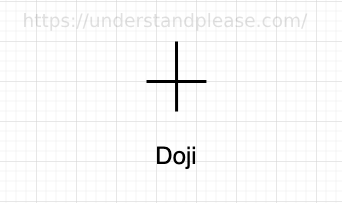

Candlestick with a very small body or no body at all, indicating market uncertainty.

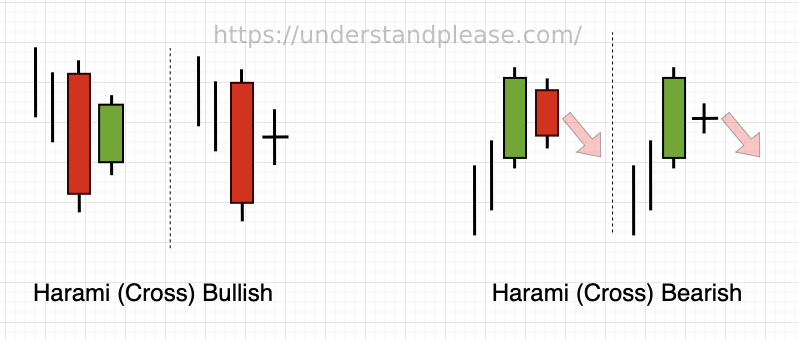

The second candlestick is smaller and within the body of the first candlestick, indicating a consolidation before continuing in the same direction.

How to Send Line Notifications Using MQL5 (Line Alert MQL5) (06/07/2024 08:30)

...Read more

Beginner's Guide to Writing an EA on MT4 using MQL4 (30/03/2025 07:30)

...Read more

Growing Butterfly Pea: Benefits and Medicinal Properties (09/11/2024 18:00)

...Read more