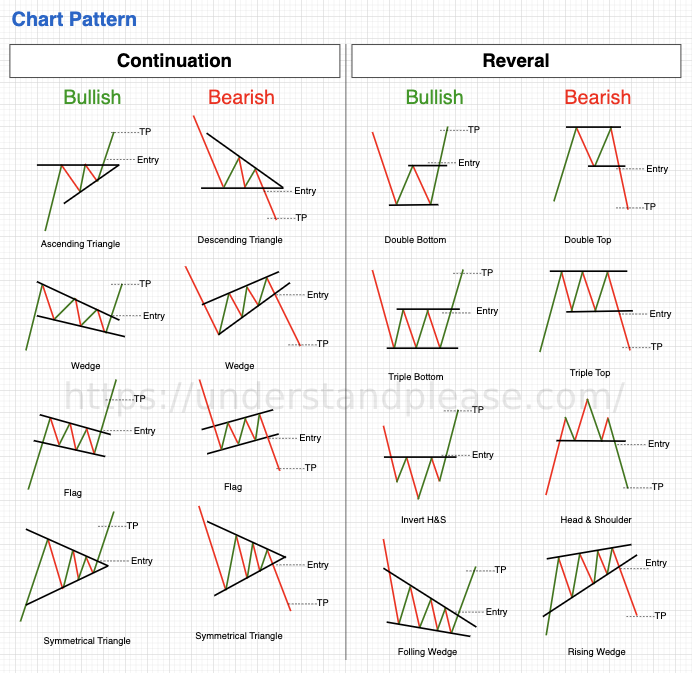

In the Forex (Foreign Exchange) market, there are several popular chart patterns that traders use to analyze market trends and make trading decisions. These chart patterns are divided into two main categories: continuation patterns and reversal patterns. Chart patterns in the Forex market are like the fingerprints of price movements, helping traders predict future price movements effectively. These patterns arise from the behavior of a large number of investors reacting to various factors, both fundamental and technical, resulting in recurring patterns that can be analyzed

A triangle pattern that is likely to continue in the same direction

It resembles a flag, where the range of price movements forms within a small rectangle, indicating a period of consolidation before continuing in the original direction

Similar to a flag, but with a small triangle indicating a temporary pause

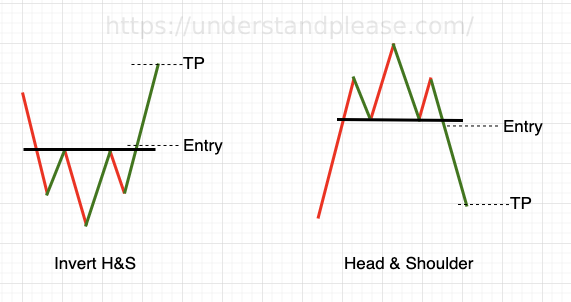

The pattern indicating a reversal from an uptrend to a downtrend consists of a head and two shoulders

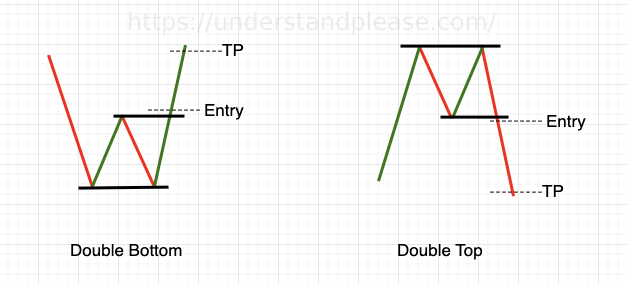

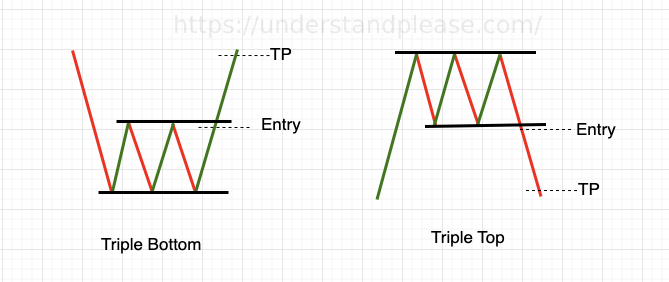

Signs of a reversal indicating the end of a trend

Similar to a Double Top/Bottom, but with three peaks or troughs

Understanding and recognizing different types of charts will help you analyze the market better and make more informed trading decisions

Chart pattern analysis is just one part of the trading decision-making process. Traders should use chart patterns in conjunction with other technical tools, such as technical indicators, to increase the accuracy of price trend predictions

Chart patterns are powerful tools for Forex traders. Understanding and applying chart patterns in market analysis can help traders make more informed trading decisions. However, traders should remember that the market is volatile and nothing is guaranteed. Continuous learning and skill development in analysis are therefore crucial

Exness Forex Broker Review: Is It Reliable? Pros and Cons (27/11/2024 23:32)

...Read more

Tesla Supercharger Stations in Thailand (24/04/2025 22:41)

...Read more

The history and legend of the origin of Phaya Krut (Garuda) (26/04/2025 15:08)

...Read more

The history of Phaya Naga and how many types of Nagas are there? (07/05/2025 11:03)

...Read more

How to Send Line Notifications Using MQL5 (Line Alert MQL5) (06/07/2024 08:30)

...Read more