Reliable forex brokers in Thailand in 2025

Investment and Financial Freedom › Reliable forex brokers in Thailand in 2025

Reliable Forex Brokers in Thailand 2025 — Compare Top Regulated Brokers

Choosing a reliable and regulated Forex broker is crucial for traders in Thailand, especially with the growing number of brokers in the market. This guide highlights key factors to consider when selecting a broker, including regulation, fees, trading platforms, and customer support — plus a list of trusted brokers operating in 2025.

1. Regulation and Licensing

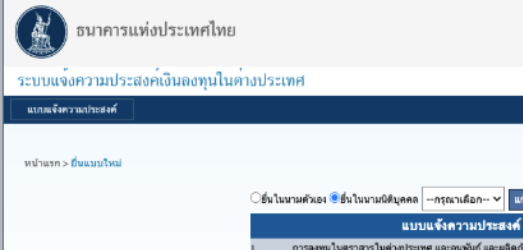

Always check that a broker is regulated by reputable financial authorities such as FCA (UK), ASIC (Australia), CySEC (Cyprus), or JFSA (Japan). Regulated brokers must follow strict operational standards and maintain client fund protection policies.

2. Fees and Spreads

Compare spreads and commission rates among brokers. Lower spreads mean lower trading costs. Also review additional fees such as deposit, withdrawal, and inactivity charges.

3. Trading Platforms

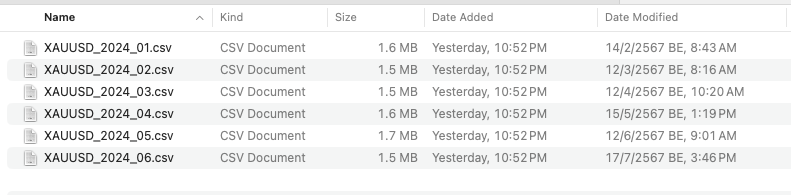

Look for brokers that offer reliable and user-friendly platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), or their proprietary trading apps.

4. Trading Products

Check if the broker provides access to various assets including currency pairs, commodities, indices, and cryptocurrencies.

5. Customer Support

A quality broker should offer responsive support via live chat, email, or phone — preferably with Thai-language assistance for convenience.

6. Deposit and Withdrawal Methods

Ensure the broker supports convenient and fast transactions via Thai bank transfers, e-wallets, or international payment systems.

7. Reputation and Reliability

Read reviews from other traders to assess credibility. Choose brokers with long operational history and transparent performance.

Top Reliable Forex Brokers in 2025

- Exness — FCA & CySEC regulated, tight spreads, MT4/MT5 supported, 24/7 Thai support.

- XM — CySEC & ASIC regulated, low spreads, no commission, MT4/MT5 supported.

- IC Markets — ASIC regulated, raw spread from 0.0 pips, MT4/MT5/cTrader platforms.

- Vantage — ASIC & FCA regulated, ECN accounts, low commission, 24/5 support.

- Eightcap — ASIC & SCB regulated, raw spreads, MT4/MT5, trusted reputation.

- Intelstellar — MT4/MT5 supported, limited public data — verify regulation before trading.

- IUX — Multi-regulated (ASIC, FSCA, FSC, SVGFSA), MT5 & proprietary apps, Thai-language support.

Overall, choosing a licensed broker regulated by agencies like ASIC, FCA, or CySEC ensures transparency, investor protection, and trading stability — essential for long-term success in Forex trading.

Please rate your satisfaction with this article

Post a Comment

Your email address will not be displayed to others. Required fields are marked *